JOIN OUR WHATSAPP GROUP. CLICK HERE

SARS Tax Return :How to send SARS return

SARS Tax Return :How do I send SARS my return Welcome SARS Tax Return Article Here you will get Helpful Guide How do I send SARS my return.

axpayers need to submit a tax return to SARS so we can calculate your tax liability based on the income you declare and the tax-deductible expenses you have incurred for a year of assessment. In some cases it may result in a refund.

The annual Filing Season is when you will be required to submit a return. For most taxpayers this runs from July to November every year.

For more information on who needs to send a return, the channels through which you can send your return, the relevant material (supporting documentation) that you will need to keep handy and more, see the information on the

Filing Season webpage.

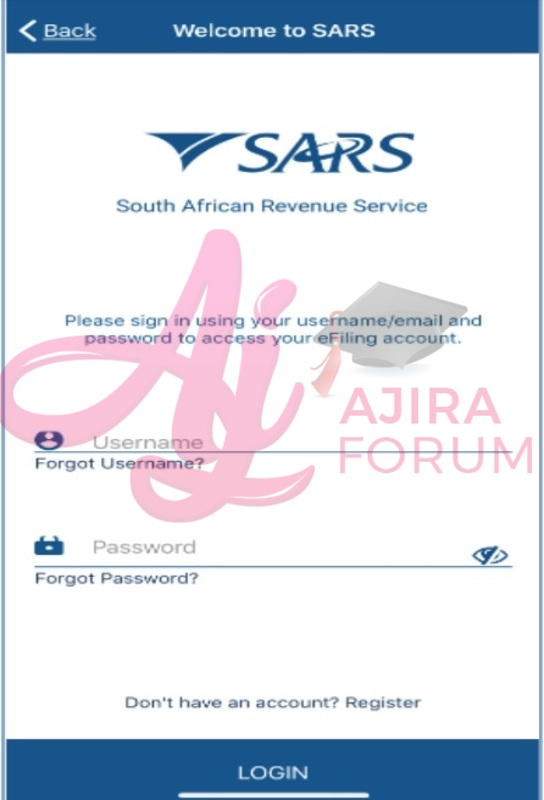

Apart from sending your return through the usual channels and the SARS eFiling website via your PC, you can now also download our MobiApp on your tablet or smartphone.

If you want to know how to get your tax number, what to do if you forgot your eFiling password, how to download the travel e-logbook, how medical tax credits work, and much more, see the Filing Season page.

How do I know the data is correct?

This year, for the first time, you can view your data in detail, as follows:

- Login onto eFiling

- Select the “Third Party Data Certificate” search button on the menu bar

- Submit / search any certificate that you wish to verify

- Select the certificate type in question.

If there is an error on your data or the data is incomplete, you can correct it by doing two things:

- Ask the institution that provided the data to SARS to correct it by sending updated data to SARS and yourself.

- When you receive the updated data, access your tax return on eFiling or MobiApp, update the data on the tax return, and file your tax return via eFiling or the SARS MobiApp.

SARS TAX DUE DATE

If a refund is due to you, then the refund will follow automatically – you do not have to ask for it. This takes approximately seventy-two (72) hours from the date on which we issued your assessment to you on eFiling or SARS MobiApp, but in some cases a little bit longer. It is important to ensure that your banking details with SARS are correct in order for SARS to pay the refund successfully.

If your assessment shows that you owe tax to SARS, it is important to make payment as soon as possible to avoid interest. The payment due date of the amount owed to SARS is displayed on the “Notice of Assessment” (ITA34).

The easiest way to make payment is to log into eFiling or SARS MobiApp and schedule the payment there.

However, you can also make payment at any branch of Absa, FNB, Nedbank, Standard Bank and Capitec, or make an electronic funds transfer (EFT) using the standard drop-down listing of pre-loaded beneficiary IDs provided by the bank. The beneficiary reference is the Payment Reference Number (PRN) listed on your notice of assessment (ITA34).

For More info Kindly Visit https://www.sars.gov.za

JOIN OUR TELEGRAM CHANNEL. CLICK HERE

Be the first to comment